|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding House Loan Options in the USA: Essential InsightsIntroduction to House LoansPurchasing a home in the USA often requires taking out a house loan, a significant financial decision. This guide will explore various aspects of house loans, helping you make informed choices. Types of House LoansConventional LoansConventional loans are popular choices for many homebuyers. They are not insured by the federal government and typically require a higher credit score. Government-Backed LoansThese loans are insured by the government, offering benefits like lower down payments. The main types include:

Factors to ConsiderInterest RatesInterest rates significantly impact the cost of a loan over time. You can choose between fixed-rate and adjustable-rate mortgages. A fixed rate equity loan provides stability with predictable payments. Loan TermThe loan term affects both monthly payments and total interest paid. Common terms are 15, 20, or 30 years. Application ProcessApplying for a house loan involves several steps. Here is a brief overview:

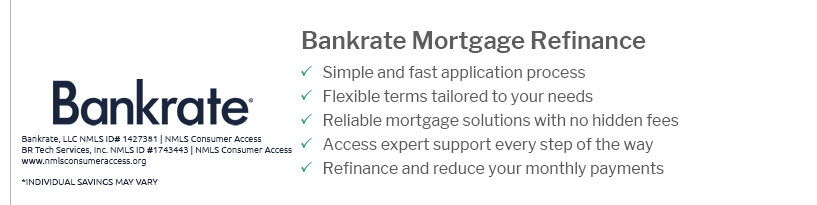

Frequently Asked QuestionsWhat is the minimum credit score for a house loan in the USA?The minimum credit score varies by loan type. For conventional loans, it is typically around 620, while FHA loans may accept scores as low as 580. How much down payment is required?Down payments can range from 3% to 20% of the home's purchase price, depending on the loan type and lender requirements. Can I refinance my house loan?Yes, refinancing is an option to lower your interest rate or change your loan term. It is advisable to assess closing costs and the new loan's total cost before proceeding. https://www.td.com/us/en/personal-banking/mortgage

Learn about TD Bank's mortgages and new home loans, get a free online quote, talk to a Mortgage Loan Officer, learn about the mortgage process and more! https://www.consumerfinance.gov/owning-a-home/explore/understand-the-different-kinds-of-loans-available/

USA.gov - Office of Inspector General. An official website of the United ... https://www.usbank.com/home-loans/mortgage.html

To lock a rate, you must submit an application to U.S. Bank and receive confirmation from a mortgage loan officer that your rate is locked. An application can ...

|

|---|